The latest exodus, coming in the wake of senior Cognizant hands leaving to head other IT companies, large PE firms and startups over the last two years, underscores the company’s struggle to retain top talent

In February 2020, public interest litigation was filed in the Madras High Court seeking an investigation into the alleged bribe by Cognizant and L&T.

After losing many business leaders to the competition, Nasdaq-listed IT firm Cognizant is now seeing a run on its senior-most executives tasked with hiring and managing employees.

At least four sources told Moneycontrol that its Indian rivals Wipro and Mindtree have snapped up five Cognizant executives who were in charge of key functions such as human resources in India, global talent acquisition, talent transformation, and entry-level workforce planning strategy.

While HR is always a critical function for a people-centric business like IT, these are particularly crucial roles in the current environment, when the business is booming for software services providers post-pandemic, leading to a huge demand for technology talent. Almost all software companies, including Cognizant, have outlined plans to hire freshers and experienced professionals on a war footing, to keep up with the rising demand and soaring attrition.

Heading to Wipro, Mindtree

While Rajiv Menon (Director-HR) and Anand Kabra (VP-Talent transformation) are expected to join Wipro to head its global recruitment and global workforce management, respectively, Suresh Bethavandu, who was the global head of talent transformation, joined Mindtree a few days ago to lead its HR function.

Ashok Ranjit Rajasekaran(early career hiring leader) and Venkat Ramaseshan (AVP-Human Resources) have also joined Mindtree in senior roles in the talent and recruitment function, sources said.

Mindtree did not comment as it is in the silent period ahead of its second-quarter results. A Wipro spokesperson said in a statement: “These individuals are not employees of Wipro. We have no further comments.” However, Moneycontrol was able to confirm that Menon and Kabra are indeed joining Wipro later this month.

Cognizant, in response to queries from Moneycontrol, shared a statement on how it continues to be a magnet for highly skilled talent. “We are investing more in the growth of our people than at any other time through training, upskilling, robust career growth, and promotions programs, with internal mobility being a key part of our talent strategy. We have a strong internal talent acquisition ecosystem strengthened by the addition of hundreds of recruiters. We have deep partnerships with 150 campuses and added over 200 campuses to give new graduates an opportunity to build a career with us.”

The statement added: “This year, we launched a hiring blitz and as a result, have a record number of new hires. We are on track to onboard 30,000 new associates this year and an additional 45,000 offers for 2022. Additionally, we are hiring 100,000 experienced talent who are trained in all the key digital skills. We have strong leadership in place, including our 11 centers across India, and continue to ensure seamless delivery for our clients around the globe."

While Cognizant said it has strong leadership for its 11 centres across India, a source told Moneycontrol that several centre heads in India have quit in the last couple of years. “In Cognizant, some of the business unit leaders also double up as centre heads. These cities have tens of thousands of employees each and the centre head plays a crucial role in retaining talent locally. The centre heads of Chennai, Delhi-NCR, Kolkata, Hyderabad, Bengaluru, and Kerala have left,” the source said.

Another source said that many of these executives chose to quit, despite the fact that they were leaving a lot of money on the table, which they would have earned from their stock options. “The cultural fabric of the company has changed.”

A third source said: “A lot of them have left the company because the company reached a phase where changes were happening but those who grew up with the company were not given the key roles. They were given to the new guard. I will not blame Brian Humphries (CEO) individually for that. They are also leaving now because the market outside is so hot.”

Why Mindtree, Wipro and L&T Infotech

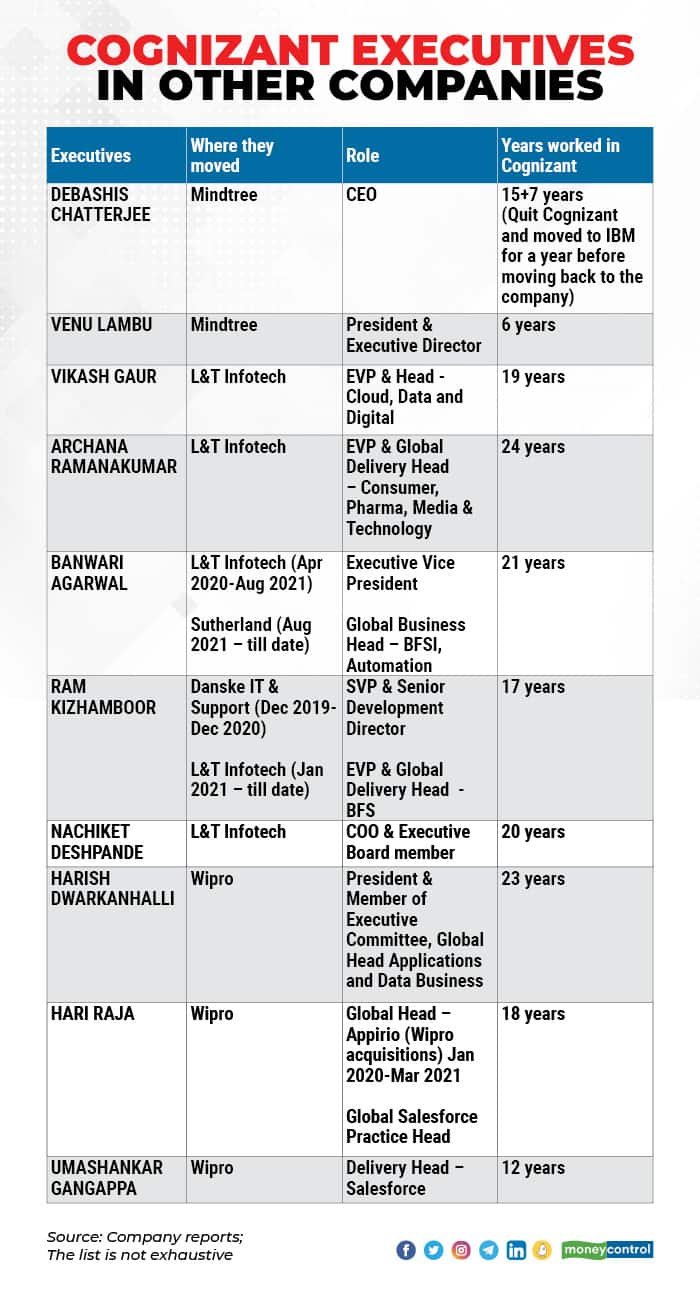

Interestingly, a lot of them seem to be joining Mindtree and L&T Infotech (see table above), apart from firms such as Wipro. In Mindtree's case, apart from its CEO Debashis Chatterjee, President Venu Lambu, and the 3 HR executives mentioned above, its Talent acquisition head for Americas (Anitha Asrani) and its Talent acquisition head for Europe (Equbeer Bedi) are also from Cognizant.

“Many of the executives that are leaving Cognizant are old timers. When they all joined Cognizant, it was a $1 billion entity. They were the size of Mindtree and L&T Infotech. Now the organisation has grown to $16.5 billion. The excitement of working in a smaller company and growing it to that size is different. This is why many of the accomplished leaders who have taken the company from $1 billion to $16 billion now essentially want to try that out again. The excitement of growing the organisation 10-fold and 16-fold is different,” an industry source said.

In the case of Wipro, they have significantly changed their brand positioning, especially since new CEO Thierry Delaporte took over. “Be it winning deals or going after good talent, they are aggressive and it is not the old Wipro that we know of,” the source said.

The HR leaders join a long list of top executives who have been leaving Cognizant in the last couple of years. These exits are likely to hurt Cognizant as they come at a time when the company is seeing record attrition and is looking at hiring 1 lakh experienced professionals.

For the April-June quarter, its attrition zoomed to a historic high of 31 percent of which 29 percent was voluntary attrition, It has an overall headcount of 301,200. Analysts said the elevated levels of attrition across levels will limit Cognizant’s ability to fulfill existing deals and go after new ones, especially in a market where the demand for outsourcing services is booming, as there is an accelerated shift to digital post-Covid-19.

It’s a risk that the CEO highlighted a few months ago when he told analysts that the company had to let go of business due to its inability to hire talent.

Even though Cognizant is Nasdaq-listed and headquartered in the US, it has always been benchmarked with its Indian peers as it has a similar industry and client profile, with a majority of its over 3 lakh employees based here. For the longest time, it was also a barometer of growth for the Indian IT industry.

While the high attrition in hot skills is an industry-wide phenomenon, Cognizant's issues extend beyond the buoyant job market.

It continues to lose leaders who have been at the company for decades. Moneycontrol reported recently that Suresh Bethavandu and Muthu Kumaran have left the company, which came on the back of two more senior executives, Arun Baid and Dan Smith, leaving, the latest among a raft of key executives who left the company since CEO Brian Humphries took charge in 2019.

Former Cognizant leaders who played key roles in building the company have now become the preferred choice of private equity firms and global IT/BPM services companies.

In the past two years alone, eight companies — Mindtree, Firstsource, Bristlecone (part of Mahindra & Mahindra), Collabera, Hitachi Vantara, Zensar, Qualitest, and Virtusa – have handpicked ex-Cognizant leaders as their CEOs. Others have joined as managing directors or CEOs of large private equity firms and startups.

Executives Moneycontrol spoke to said this ends up having a multiplier effect. Many leaders who quit to take up bigger roles in other organisations end up picking a lot of their hires from Cognizant.

According to a report by Kotak Institutional Equities published a few months ago, Cognizant has also lost market share to peers due to insourcing, with a ransomware attack also impacting service delivery. So, it may not benefit from vendor consolidation in financial services, which is its biggest industry segment in terms of revenues. It has also not announced large deals as TCS, Infosys, or Wipro have done, even as it has made a string of acquisitions.

0 Comments