New Income Tax slabs: In absolute terms, out of 5.78 crore tax filers, about 5.3 crore (91.7 per cent) claimed deductions of less than Rs 2 lakh, including those under section 80C, Section 80D, section 80CCD(1B) (additional deduction of NPS), deduction for housing loan interest and standard deduction in 2018-19.

Union Finance Minister Nirmala Sitharaman, flanked by her deputy Anurag Thakur (to her right) and a team of officials, shows a folder containing the Union Budget documents as she at Parliament in New Delhi

Justifying the introduction of new personal income tax slabs and rates, Revenue Secretary Ajay Bhushan Pandey told The Indian Express Sunday that it was a move away from an “inequitable direct tax regime” — and cited an analysis by his department that almost 92 per cent of those filing I-T returns availed exemptions of less than Rs 2 lakh.

In absolute terms, out of 5.78 crore tax filers, about 5.3 crore (91.7 per cent) claimed deductions of less than Rs 2 lakh, including those under section 80C, Section 80D, section 80CCD(1B) (additional deduction of NPS), deduction for housing loan interest and standard deduction in 2018-19.

Only 3.77 lakh taxpayers, less than 1 per cent of all tax filers, claimed deductions of over Rs 4 lakh, according to the department’s analysis.

Pandey said the new structure addressed issues of equity, and that he expected new entrants to the job market, smallscale business owners and those who have retired to move to the new regime.

“If you have a flat tax rate, it becomes inequitable in the way that you are taxing the rich and poor… Having a few tax slabs also becomes inequitable because there is a sudden jump…and there will be a tendency to understate income to get to a lower slab. Therefore, a progressive taxation system in income tax is internationally considered to be one of the best practices…if the level of income inequality is high in a society, it is much more simple and desirable to have multiple and graded income tax-structure,” he said.

Explained | As 15th Finance Commission report is tabled in Parliament, a look at what this body is — and what it does

In her post-Budget media interaction Sunday, Finance Minister Nirmala Sitharaman said the new regime will definitely ease the tax burden on many taxpayers. The intention of the government was to lower taxes over time along with elimination of exemptions and deductions, she said.

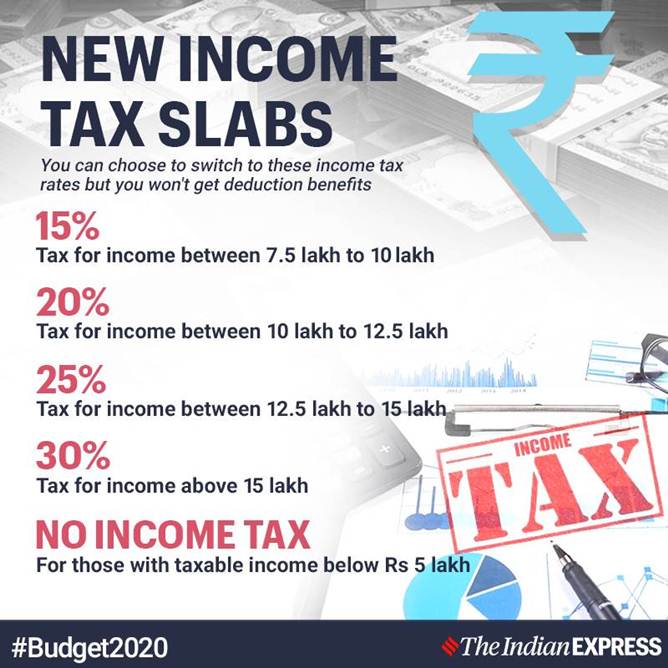

The new structure offered “deep cuts” in rates for middle class and lower middle class, she argued. This scheme will co-exist with the existing structure and will be optional. While the existing tax system has four tax slabs, the new one has seven tax slabs and offers lower rates.

“It will be obvious for anyone to see that because the rate cuts are deeper in the new scheme, we believe a taxpayer from a particular income bracket will be much better off coming into the new system. And the new system, however much I repeatedly say has no exemptions, there are a few exemptions also that we have allowed in the new system,” she said.

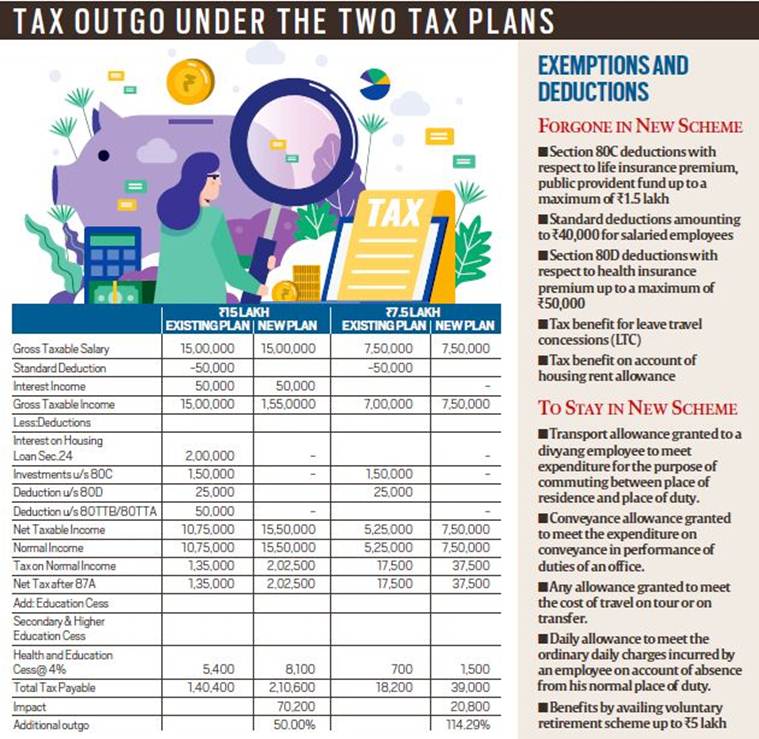

While calculating whether taxpayers will be better off in the new regime after forgoing exemptions, one also needs to take into account exemptions that have been continued. Once an individual opts for the new tax plan, there’s no returning to the existing plan that offers deductions and exemptions.

Pandey said it was tough to put a number to how many would opt for the new regime. “It is providing relief to those who, because of family circumstances or life situations, are not availing those exemptions or are not in a position to avail those exemptions. If the earlier system was inequitable to that section of taxpayers, why should they suffer? Therefore, we have provided relief,” he said.

“If there is someone above the age of 60, why would he need to put money in provident fund; why would he take life insurance; what he will take is some amount of health insurance. Why will he take a housing loan? He’s getting a pension, he has a certain number of years in his life and he would like to use that money. But because, for him, there was no scope or incentive to invest in such instruments, he was at a disadvantage,” Pandey said.

“Another class of people could be small businessmen. Today, he doesn’t get LTC, doesn’t get food coupons and various other benefits. He is also not getting standard deduction, so what should he do? At most, he can take benefits of around Rs 1.5 lakh to Rs 2 lakh. He will file his return and if he finds, the new regime is advantageous, he will choose it. Otherwise, he will choose the old system,” he said.

The Revenue Secretary also said that not all those claiming exemptions will opt for the new regime since the decisions would be dependent on income level.

Asked if the government had a roadmap for doing away with exemptions, Pandey said 70 of the exemptions have been removed in the new, simplified regime and the government will review or rationalise the remaining exemptions and deductions in the coming years “with a view to further simplify the tax system and lowering the tax rate”.

“The other system will continue. As of today, if we had to remove exemptions, we could have removed it from the older regime… but there is no plan, as of today. We have provided this new option and if, say, 90 per cent of people shift to the new system, then what is to be done with the remaining 10 per cent, we will see at that time. Why should we indulge in speculation today?” he said.

The system to offer a lower income tax rate without exemptions is similar to the government’s decision to offer a lower corporate tax rate without exemptions taken in September last year. Pandey, when asked about the net gain from the earlier decision, said that 90 per cent of the companies have opted for the new corporate tax regime.

Further, Pandey said the online functionalities would be made available by the tax department for taxpayers to see their liabilities under both regimes. In her Budget speech, Sitharaman had said, “We have also initiated measures to prefill the income tax return so that an individual who opts for the new regime would need no assistance from an expert to file his return and pay income tax.”

New income tax slabs announced in Budget 2020

New income tax slabs announced in Budget 2020 Tax outgo under the two plans

Tax outgo under the two plans

0 Comments